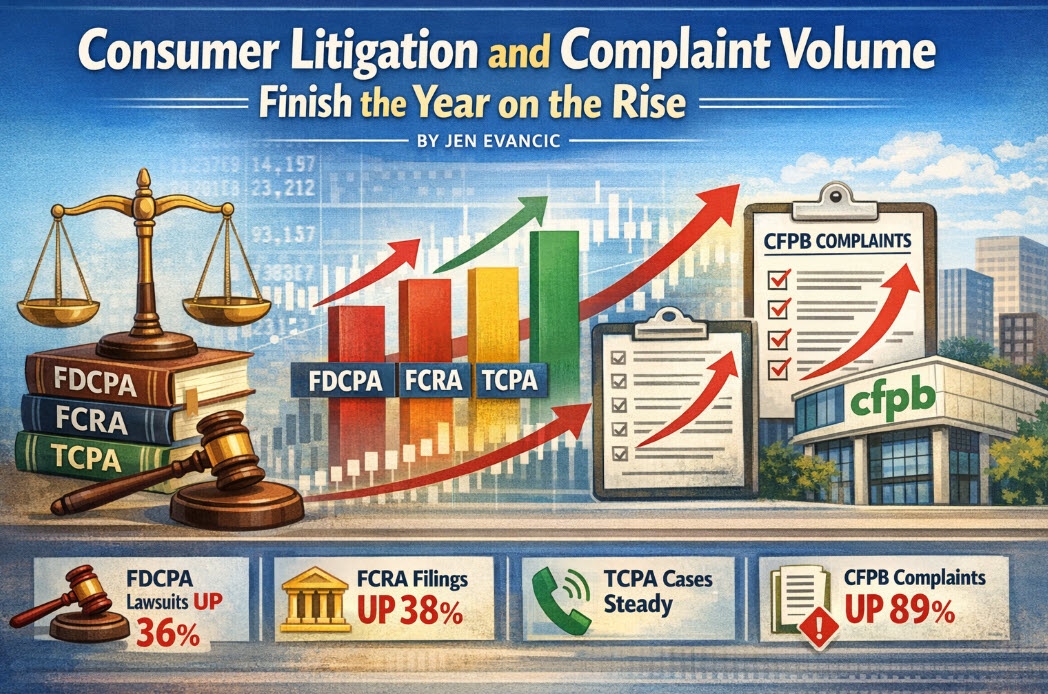

New Legislation Seeks Stronger Verification Standards for CFPB Complaint Database

U.S. Rep. Andy Barr (R-Ky.) recently introduced H.R. 7588, the Eliminating Fraud in the CFPB’s Complaint Database Act, legislation aimed at strengthening the accuracy and integrity of the Consumer Financial Protection Bureau’s public Consumer Complaint Database. The bill proposes amendments to the Consumer Financial Protection Act of 2010 by adding stricter verification requirements for individuals submitting complaints and implementing additional reforms to how complaints are processed and published. Legislation Overview H.R. 7588 seeks to formalize and […]