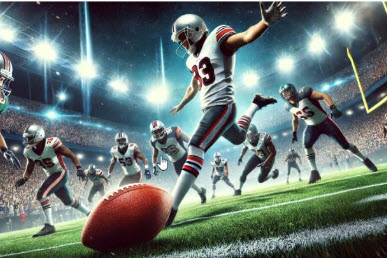

My husband is a life-long Detroit Lions fan, and as season ticket holders, we’ve witnessed our fair share of heartbreak and triumph. At a recent game against the Buffalo Bills, as I watched the strategy and execution unfold on the field, it struck me—being part of an NFL team isn’t so different from auditing collection agencies and repossession forwarders.

Think about it:

-

Creditors are the offense, driving the action and creating opportunities.

-

Collection agencies and repossession forwarders are the defense, tasked with protecting assets and minimizing losses.

-

Auditors? We’re the fans in the stands, cheering or critiquing as we observe the results of their strategies.

From the stands, it’s easy to determine if a strategy worked—or didn’t. But just like football, the game of collections and repossession is far more complex when you’re the one calling the plays. Many fans were frustrated when an onside kick was called—but what we didn’t know was everything that went into that decision: three defensive players were injured and out of the game, and one of the league’s best running backs was sidelined. The same is true in auditing—what may seem like a questionable choice at first often has layers of reasoning and unseen challenges behind it.

AUTHOR: Bev Evancic, Senior Vice President, Resource Management Services, Inc.

Bev Evancic is a Senior Vice President at Resource Management Services, Inc. Prior to employment at RMS, Bev worked as the Collection and Recovery Manager at AT&T Universal Card, Citi, and Federated Department Stores. Bev started in the collection industry as a collector at an upscale clothing store in Cincinnati, Ohio. As a returned check and private label credit card collector, Bev gained a basic understanding of the collection industry that has not changed with the introduction of regulations. Her collection philosophy begins with the idea that businesses and customers benefit from preserving the customer relationship. First, collectors need to attempt to contact customers when it is convenient for the customer to discuss his/her financial condition and willingness/ability to pay. Second, you never collect money by intimidating or threatening customers. Third, businesses must make sure the debt is valid.

She has managed all phases of collection and recovery operations, including automated dialer units, bankruptcy, and legal units, skip tracing units, internal collections, outside collection agency networks, and Consumer Credit Counseling. As a Consultant for Resource Management Services, Inc., Bev has spearheaded collection and recovery best practices reviews for many top credit grantors. Her articles on dialer operations, agency management and bankruptcy best practices have been widely publicized.

She is well known and regarded as a specialty expert in the areas of: Repossession, Bankruptcy, Estate, Litigation, as well as Pre- and Post- Charge-off. Prior to joining Resource Management Services, Inc. in 1995, Bev managed the Recovery Department for AT&T Universal Card Services where she developed the bankruptcy, probate, internal and litigation processes.

She is the author of “Recovery Management: Collecting the Uncollectible Account.”