Being a Collector is not an easy job — it comes with its own set of challenges and emotional tolls. In every interaction with a customer, a Collector must be the adult in the room. Regardless of what the customer says, threatens, or insinuates, the Collector is responsible for staying calm, professional, and focused on managing the relationship.

Often, customers do not recognize or appreciate the genuine effort and concern a Collector brings to help them navigate a messy financial situation. But that does not make the work any less valuable.

In fact, as I shared in my previous blog, “A Collector or an Astronaut?”, the role of a Collector can be just as critical and impactful.

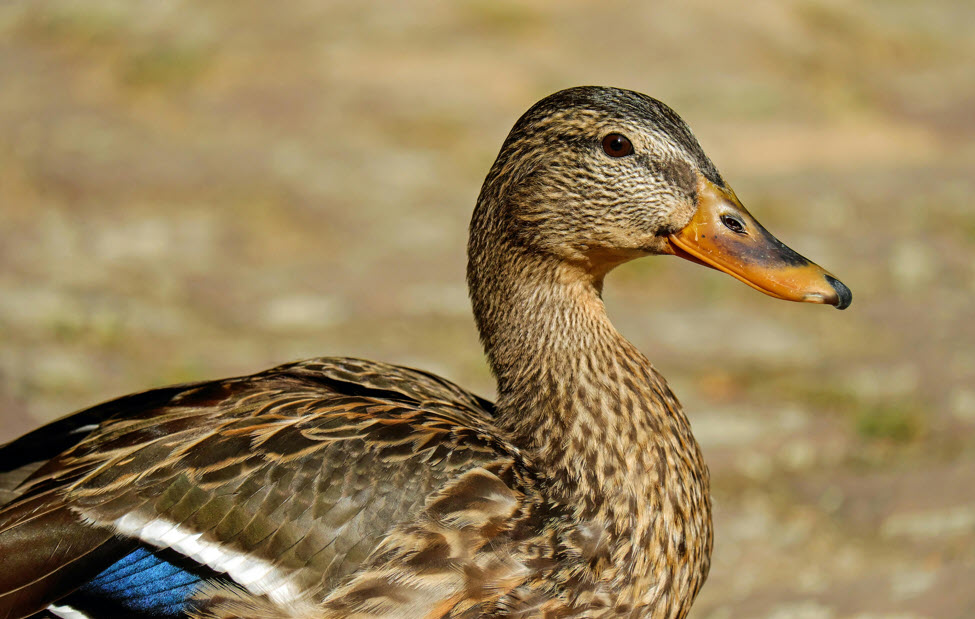

So why do I reference a duck?

You may have heard the phrase: “Like water off a duck’s back.” It means that criticism, insults, or negative comments slide off without leaving a mark — they do not bother the duck at all. That is exactly the mindset a Collector must adopt.

When facing difficult or hostile customers, a Collector needs to find their inner duck — letting the negativity roll off and staying focused on the goal: resolution with respect.

How to Be a Duck?

There are seven key points to being a duck:

Maintain Emotional Detachment – Tip: Remind yourself, “This isn’t personal.”

- Customers may lash out from stress, fear, or frustration. Their anger is usually about their situation — not about you.

- Take any chips off your shoulder – do not attempt to win the situation. The ultimate goal is a win-win-win for the customer, Collector, and company.

Take a Mental Break

- Take slow, deep breaths during or between calls to stay centered.

- Use a technique like box breathing: Inhale for 4 seconds, hold for four, exhale for four, hold for four.

Remember the Mission

- Shift your perspective: “This person is struggling, and I’m here to help.”

- Viewing the interaction through a lens of empathy instead of confrontation helps you stay calm. Refer to my previous blog, “Building a Relationship Over the Phone,” for tips on how to improve the interaction with the customer.

Know Your Script and Procedures

- Confidence comes from preparation. Know your talking points, your company’s policies, and your personal boundaries. A customer will respond to confidence and leadership. If you listen and respond with solutions or recommendations that align with the customer’s situation, you provide a win.

- If a customer becomes abusive and does not productively participate in the conversation, it is okay to calmly end the call. Make sure you are not the reason the call went out of control. Refer to my previous blog “Can a Goat be a Great Collector” for pointers.

Debrief After Tough Calls

- Do not carry one bad call into the next. Take a minute to shake it off — stand up, stretch, or jot down a quick reflection.

- Use a mantra like: “Reset. I am starting fresh.” And get back at it, there are a lot of customers that need your help.

- Use the spin technique, see how many times you can spin in your chair without stopping – always a nice relaxing practice.

Coaching Works

- Talk with Managers and fellow Collectors. Sharing stories and strategies can help normalize tough experiences and give you perspective. Coaching helps improve the customer interaction.

- Review call recordings with your Manager and identify what happened on the call. Verify that your word choices, phrases, tone, and other communication tools were aligned perfectly for a productive and engaging conversation with the goal of “Building a Relationship Over the Phone.”

Big Picture – Keep Your Purpose in Sight

- Remind yourself why you’re doing this job — to help people regain financial stability. Be better than an Astronaut.

- Staying connected to your mission can help you rise above the noise. Be the Duck!

Conclusion: Be the Duck — Every Call, Every Time

In the world of collections, staying composed under pressure is not just a nice-to-have skill — it is essential.

The ability to let negativity roll off, maintain your professionalism, and focus on helping the customer is what sets great Collectors apart.

Each call is an opportunity — not just to collect a payment, but to guide someone through one of the most stressful times in their life.

And while customers may not always recognize the effort you put in, the impact of your work is real and meaningful.

So when the pressure builds, when the insults fly, when the stress feels like too much — remember your purpose, take a breath, reset, and find your inner duck.

Stay calm, stay confident, and keep showing up with empathy and integrity.

You are not just a Collector. You are a problem-solver, a listener, and sometimes, a lifeline.

Be the adult. Be the leader. Be the duck.

Thank you to Chris Straiter for pointing me in the direction of a Duck for our wildlife series.

Author: Ken Evancic

Ken.Evancic@ResourceManagement.com

As a consultant for Resource Management Services, Ken provides consulting, training and mentoring in all phases of collection and recovery, in addition to auditing third party vendors.

Ken Evancic is a Vice President at Resource Management Services, Inc. Ken Evancic is a collections veteran with over 25 years experience. He has managed all phases of collection, including all levels of delinquency, automated dialer units, early out agency management, recovery, and skip tracing. In addition to collections operations management, he has lead initiatives in the areas of performance management, collections strategy development, collector and manager training, collector desktop design, collections reporting systems, and risk and compliance.

As a consultant for Resource Management Services, Inc., Ken has specialized in developing and completing third party compliance and performance audits for collections agencies and collection attorney firms for many top credit grantors and debt buyers. He has leveraged his 25 years of experience to develop multiple collector and collection management training classes designed to maximize collector performance. In addition to collection training, Ken helped develop and facilitates the RMS Third Party Vendor Auditing training.

Additional Training and Blogs Available

If you need some training assistance for your team, you may want to consider:

Bump It Up! Your Collections Success-Virtual Training for Your Team, taught by Ken Evancic.

Custom Consulting Available

With expertise and experience in collections, oversight and compliance, we understand the challenges faced by creditors in managing collections and recoveries while adhering to ever-evolving regulatory standards.

That’s why our team of seasoned experts is dedicated to providing tailor solutions that address your unique collection and compliance requirements.

From comprehensive consulting services to specialized training programs and meticulous oversight of third-party vendors, we offer a comprehensive suite of services designed to empower your team and optimize your compliance strategies.

Contact our blog authors or Write to us at info@resourcemanagement.com for more information.

www.resourcemanagement.com

Sign Up for the Twice Monthly Newsletter

Just enter your email address at the top orange bar at:

Collection Compliance Experts – “The Power of Expertise: Oversight Perfected”

It’s that easy! Twice a month – we provide blog updates and Resources for the Collection and Industry Professional.

Your email is just for this newsletter. We never sell your information. No fee. Opt-out at any time.