The Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on Household Debt and Credit, offering key insights into the state of American debt. Accompanying the report is a Liberty Street Economics blog post that explores trends in debt-to-income ratios and what they reveal about Americans’ ability to manage their debt. The New York Fed’s analysis of delinquency is comprehensive, so rather than reiterate their findings, I encourage you to explore the full report and blog through the links provided.

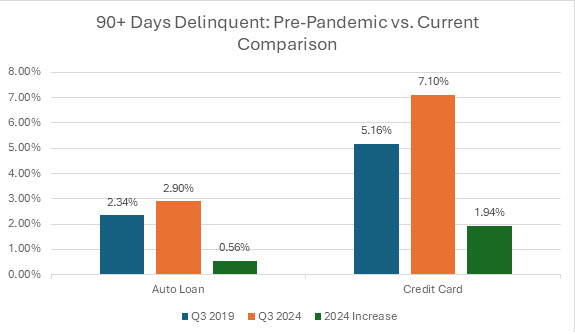

For anyone in daily collection operations, it’s clear: most loan types have not only returned to pre-pandemic delinquency levels but, in the case of auto loans and credit card debt, have even surpassed them. A particular concern is the sharp rise in accounts 90+ days past due for these categories.

From a Collector’s Point of View

As a collector rather than an economist, I can’t help but think part of the increase in auto loan delinquencies may stem from pandemic-era vehicle purchases made at inflated prices. Due to limited supply, many customers took out loans for older vehicles, something that was less common before the pandemic. Since then, used car prices—including auction values—have dropped, leaving some borrowers in a tough spot. This shift has also put creditors in a challenging position.

As I mentioned earlier, speaking as a collector rather than an economist, credit card delinquencies often reflect broader economic conditions like high inflation and rising interest rates. What stands out in today’s credit card debt, however, is the shift in spending patterns—there appears to be an increase in luxury and travel purchases rather than spending focused on everyday essentials. This could suggest that borrowers who have maxed out their credit cards may now find themselves unable to make even the minimum payments.

For a deeper dive, follow the links to the Fed’s full report and blog post:

Household Debt Rose Modestly; Delinquency Rates Remain Elevated – FEDERAL RESERVE BANK of NEW YORK

Income Growth Outpaces Household Borrowing – Liberty Street Economics

Author: Bev Evancic

Bev.Evancic@ResourceManagement.com

As a consultant for Resource Management Services, Bev provides consulting, training and mentoring in all phases of collection and recovery, in addition to auditing third party vendors (financial reviews, collections, repo and more).

Bev Evancic is a Senior Vice President at Resource Management Services, Inc. Prior to employment at RMS, Bev worked as the Collection and Recovery Manager at AT&T Universal Card, Citi, and Federated Department Stores. She has managed all phases of collection and recovery operations, including automated dialer units, bankruptcy, and legal units, skip tracing units, internal collections, outside collection agency networks, and Consumer Credit Counseling. As a Consultant for Resource Management Services, Inc., Bev has spearheaded collection and recovery best practices reviews for many top credit grantors. She is well known and regarded as a specialty expert in the areas of: Repossession, Bankruptcy, Estate, Litigation, as well as Pre- and Post- Charge-off. She is the author of “Recovery Management: Collecting the Uncollectible Account.”

Sign Up for the Twice Monthly Newsletter

Just enter your email address at the top orange bar at:

Collection Compliance Experts – “The Power of Expertise: Oversight Perfected”

It’s that easy! Twice a month – we provide blog updates and Resources for the Collection and Industry Professional.

Your email is just for this newsletter. We never sell your information. No fee. Opt-out at any time.