If you have listened to collectors working on auto deficiency accounts, you will see that it is very challenging to encourage customers to pay. Part of the problem is that collectors often struggle to understand the loan process for charged-off or repossessed auto loans. The typical response is that it’s not about the vehicle; it’s about the loan taken from the finance company. This often ends the discussion about why the loan needs to be paid.

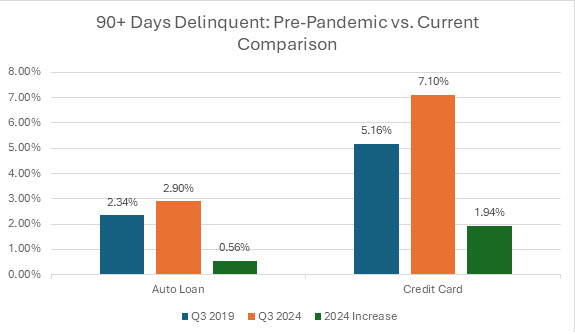

Now, we have more proof that auto deficiency balances often start as potentially higher-risk loans. The CFPB has shared information highlighting that many auto loans include elements that create difficult situations for both the customer and the collector.

The CFPB’s Research Results

As of the fourth quarter of 2023, Americans had over $1.6 trillion in auto loans with more than 100 million active accounts. Despite this large market, detailed data is scarce. In February 2023, the CFPB initiated the auto finance data pilot, issuing nine monitoring orders to three banks, three finance companies, and three captive lenders to gain insights into their auto lending portfolios. This initiative aims to understand loan attributes that may cause consumer distress.

This report, the first in a series using this collected data, focuses on the issue of financing negative equity, which occurs when the trade-in value of a vehicle is less than the outstanding loan balance, and the unpaid balance is rolled into a new loan. Including negative equity in financing can further disadvantage consumers, increasing the risk of a deficiency balance if they cannot repay the loan.

Key findings of the CFPB report include:

- Consumers who financed negative equity were more likely to face repossession within two years.

- These consumers financed larger loans, leading to average month payments 27% higher than those with no trade-in and 26% higher than those with positive trade-ins.

- Consumers with negative equity had lower credit scores, lower household income, longer loan terms, and were more likely to have a co-borrower.

- Consumers also had higher loan-to-value and payment-to-income ratios.

- Nearly a quarter of consumers financing less expensive vehicles included negative equity in their loans, compared to nearly 16% for more expensive vehicles.

- The proportion of negative equity financed was higher for less expensive vehicles.

What Can be Done?

Collectors often struggle to understand the complexities of auto finance, making it difficult for them to relate to customers who are behind on their auto deficiency payments. It is crucial to train collectors on the auto loan process, especially for customers who have had their vehicles repossessed. Based on calls I have monitored, many collectors lack this understanding and sometimes fabricate events. Here’s a guide on training collectors about the typical steps involved in a repossessed auto loan, from origination to collection:

Loan Origination:

- Customer Excitement: The customer visits a dealership and is thrilled to be approved for a loan, as they lack sufficient cash to purchase the car outright.

- Dealer Finance Manager’s Role: The finance manager explains numerous documents to the customer, who is often distracted by their new car and misses key points:

- The necessity of liability insurance to protect the lender.

- Additional insurance costs if the lender has to insure the vehicle due to a lapse.

- The requirement for timely monthly payments.

- The lender’s right to repossess the vehicle if the loan defaults.

- The possibility of redemption by paying what is owed to reclaim the vehicle.

- Responsibility for the remaining loan balance after the vehicle is sold, subtracting auction proceeds, and adding repossession costs.

- The limitations of gap insurance, especially concerning negative equity from a trade-in.

Completion of Purchase:

- Paper Signing: The customer signs the documents and takes possession of their new car.

- Dealer’s Payment: The dealer receives full payment for the car, relinquishing ownership and generally refusing to take the vehicle back.

Ownership and Responsibility:

- Customer and Lender’s Ownership: The customer and lender jointly own the vehicle, with the customer fully responsible for it.

- Insurance Requirements: The customer must maintain sufficient insurance coverage. If it lapses, the lender will secure insurance to protect their interest and charge the customer.

Loan Default and Repossession:

- Ongoing Responsibility: The customer remains responsible for the auto loan regardless of their ability to pay, insurance issues, theft, mechanical problems, or total loss accidents.

- Collection Actions: If the loan is overdue or in default, the lender will take appropriate actions as detailed in the contract. The customer is notified of what is owed and potential repossession.

Misunderstandings and Repossession:

- Customer Misconceptions: Some customers believe returning the vehicle to the dealer resolves their financial obligation. This is usually incorrect, and they remain responsible for the loan payments.

- Repossession Process: The car is repossessed and stored, giving the customer limited time to reclaim it, often at a cost higher than the missed payments.

Post-Repossession:

- Auction and Fees: The car is sold at auction, often for less than the loan balance. The customer is liable for the remaining loan balance, plus repossession and other fees.

- Notification of Balance: The customer receives a letter detailing the new loan balance and payment requirements.

- Collection Agency Involvement: The auto loan is typically forwarded to a collection agency, where collectors play a crucial role.

The Role of Collectors

Collectors should avoid telling customers they should have been aware of all these details before purchasing the vehicle. Recognize that the day of purchase was a joyous occasion for the customer, likely shared with friends and family. Over time, however, the excitement fades as the reality of payments sets in, and life changes can lead to financial difficulties.

Understanding the auto loan process is essential for collectors to have informed, empathetic conversations with customers, explaining their responsibilities and the reasons behind their outstanding loan balances.

Recommendation for Collection Leadership

There is no magical solution to resolving an auto deficiency balance. In my blog post, “Resolving the Customer’s Financial Situation?”, I emphasize the importance of collectors listening to customers and responding with accurate information about their loans. Without a solid understanding of the repossession process and the ability to communicate it effectively, collectors are unlikely to achieve resolution.

Ideas to Help Collectors:

- Comprehensive Training: Develop training programs that cover the entire auto loan process from start to finish. Use the light-hearted example provided above as a starting point.

- Practice and Role-Playing: Have collectors engage in role-playing exercises using real auto loan contracts and other relevant documentation.

- Call Monitoring and Coaching: Regularly monitor calls and provide coaching to highlight steps that could improve conversations with customers.

Each customer is unique, so no two calls will be the same. Training collectors on the intricacies of the auto loan process helps establish a strong foundation, enabling them to effectively assist each customer in resolving their financial situation related to their auto loan.

Summary

Collectors often struggle with auto deficiency accounts due to a lack of understanding of the auto loan process, especially in cases involving repossession. The CFPB’s research highlights that loans with negative equity pose higher risks, leading to more repossessions and greater financial burdens on consumers. Training collectors on the complete auto loan process—from origination to post-repossession—is essential. This includes comprehensive training programs, role-playing exercises with real loan documents, and regular call monitoring with coaching. Understanding the intricacies of auto loans allows collectors to have empathetic and informed conversations, helping customers resolve their financial situations effectively.

Co-Author: Jennifer Evancic Greenawalt

Jennifer.Evancic@ResourceManagement.com

Jennifer Evancic is a third-party auditor valued by creditors and large organizations for her knowledge in call monitoring within the collections industry. With meticulous attention to detail and a firm grasp of regulatory requirements, she ensures compliance with clients’ criteria and state and federal regulations.

Jennifer audits collections calls, ensuring they meet client-specific criteria and comply with regulations, providing valuable insights and maintaining industry standards.

Beyond her auditing responsibilities, Jennifer takes the lead in organizing and facilitating monthly call calibrations. These sessions serve as a collaborative forum where clients and their vendors come together to discuss call monitoring results and address any findings or areas for improvement. Jennifer’s guidance fosters open communication and ensures alignment between clients and vendors, driving continuous improvement in collections practices.

Jennifer stays up-to-date with compliance and industry best practices by participating regularly in peer meetings, regulatory updates and industry webinars. This keeps her informed about emerging issues and ensures she remains a knowledgeable leader in collections compliance.

Co-Author: Ken Evancic

Ken.Evancic@ResourceManagement.com

As a consultant for Resource Management Services, Inc., Ken has specialized in developing and completing third party compliance and performance audits for collections agencies and collection attorney firms for many top credit grantors and debt buyers. He has leveraged his 25 years of experience to develop multiple collector and collection management training classes designed to maximize collector performance. In addition to collection training, Ken helped develop and facilitates the RMS Third Party Vendor Auditing training.

As a consultant for Resource Management Services, Ken provides consulting, training and mentoring in all phases of collection and recovery, in addition to auditing third party vendors.

Sign Up for the Twice Monthly Newsletter

Just enter your email address at the top orange bar at:

Collection Compliance Experts – “The Power of Expertise: Oversight Perfected”

It’s that easy! Twice a month – we provide blog updates and Resources for the Collection and Industry Professional.

Your email is just for this newsletter. We never sell your information. No fee. Opt-out at any time.